- Admin

- #1

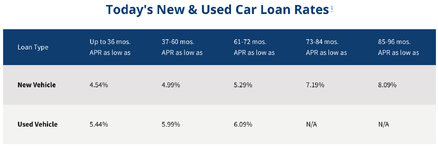

What bank/credit union has the most competitive interest rates for auto loans right now?

USAA is offering 5.74% on 60 months., but I'm curious if there are better deals elsewhere.

USAA is offering 5.74% on 60 months., but I'm curious if there are better deals elsewhere.

Last edited: